Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. However, sometimes there are differences between the two balances and so you’ll need to identify the underlying reasons for such differences. After adjusting all the above items what you’ll get is the adjusted balance of the cash book. However, there can be situations where your business has overdrafts at the bank, which is when a bank account goes into the negative as a result of excess withdrawals. Not-sufficient funds (NSF) refers to a situation when your bank does not honour a check, because the current account, on which the check is drawn, has insufficient funds.

Where Do Non-Sufficient Funds (NSF) Checks Go on a Bank Reconciliation?

- This means that the check amount has not been deposited in your bank account and hence needs to be deducted from your cash account records.

- If you find any errors or omissions, determine what happened to cause the differences and work to fix them in your records.

- While reconciling your books of accounts with the bank statements at the end of the accounting period, you might observe certain differences between bank statements and ledger accounts.

- For simplicity, our examples and discussion assume that the company has only one checking account with one general ledger account entitled Cash.

- Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses!

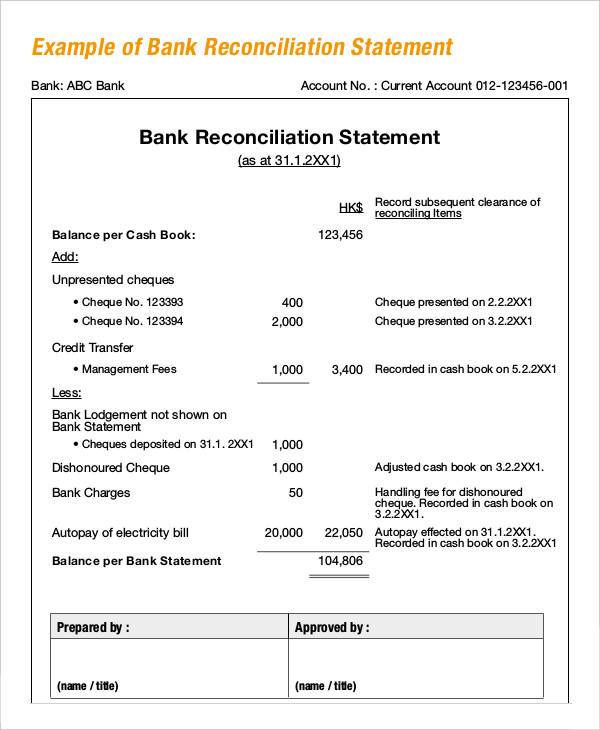

But this is not the case as the bank does not clear an NFS check, and as a result, the cash on hand balance gets reduced. When done frequently, reconciliation statements help companies identify cash flow errors, present accurate information to investors, and plan and pay taxes correctly. They can also be used to identify fraud before serious damage occurs and can prevent errors from compounding. A bank reconciliation statement is only a statement prepared to stay abreast with the bank statement; it is not in itself an accounting record, nor is it part of the double entry system.

Bank Reconciliation Terminology

The bank statement submitted by the businessman at the end of May will not contain an entry for the check, whereas the cash book will have the entry. Adjust the cash balances in the business account by adding interest or deducting monthly charges and overdraft fees. Bank errors are mistakes made by the bank while creating the bank statement. Common errors include entering an incorrect amount or omitting an amount from the bank statement.

Comparing Accounting: Bank vs. Company

First, bank reconciliation statements provide a mechanism of internal control over cash. In cases where you discover discrepancies that cannot be explained by your financial statements, it’s best to contact your bank. It’s possible that a banking error has occurred or that you have been charged for something you were unaware of. If the charges are not from your bank, the bank can also help you identify the source so that you can prevent any fraud or theft risk.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Reconciling bank statements with cash book balances helps your business know the underlying causes of these balance differences. Once the underlying cause of the difference between the cash book balance and the passbook balance is determined, you can then make the necessary corrections in your books to ensure accuracy. Bank charges are service charges and fees deducted for the bank’s processing of the business’s checking account activity.

Keeping on top of your bank reconciliation ensures that you’re always aware of your company’s financial situation. This helps you anticipate any cash flow challenges so you can respond appropriately. Financial accuracy is also important for ensuring that all payments have been fulfilled and orders have been completed. Go through both statements and highlight any transactions that appear on only one side. Note that transactions may take a few days to clear, so the transaction date in your financial records may not precisely match the date on your bank statement.

One reason for this is that your bank may have service charges or bank fees for things like too many withdrawals or overdrafts. Or there may be a delay when transferring money from one account to another. Or you could have written a NSF check (not sufficient funds) and recorded the amount normally in your books, without realizing there wasn’t insufficient balance and the check bounced. You only need to reconcile bank statements if you use the accrual method of accounting. This is to confirm that all uncleared bank transactions you recorded actually went through. In order to prepare a bank reconciliation statement, you’ll need to obtain both the current and the previous month’s bank statements as well as the cash book.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. When you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 12 different Certificates of Achievement. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting contract issues when buying an accounting or cpa practice supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

These checks are in transit, so they haven’t yet been deposited into the company’s bank account. He also finds $500 of bank service fees that hadn’t been included in his financial statement. Once you’ve identified all the items that align between the two records, it’s time to account for any discrepancies.