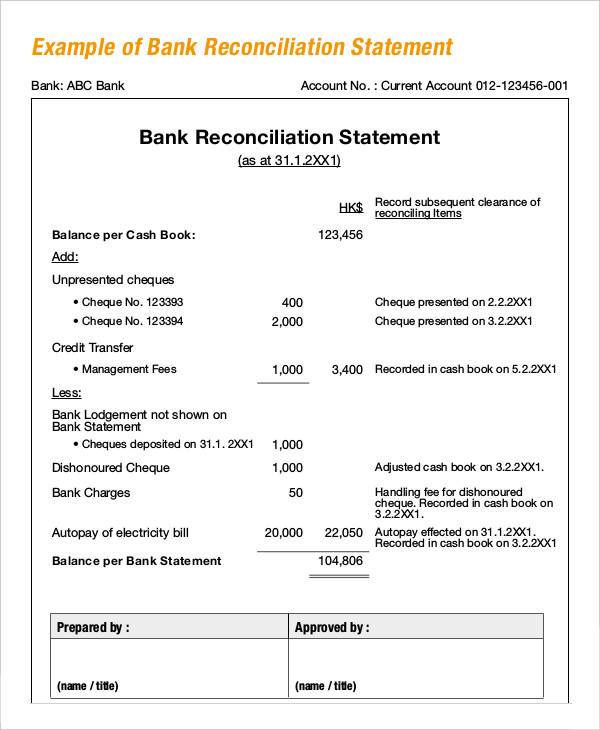

A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Reconciling the two accounts helps identify whether accounting changes are needed. Bank reconciliations are completed at regular intervals to ensure that the company’s cash records are correct. A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Reconciling the two accounts helps determine if accounting changes are needed.

Why You Can Trust Finance Strategists

Accounting for these delays is key to reconciling the total amounts on the company’s financial statement and the bank statement. You receive a bank statement, typically at the end of each month, from the bank. The statement itemizes the cash and other deposits made into the checking account of the business, as well as any expenses paid by the business. This includes everything from wages and salaries paid to employees to business purchases like equipment and materials. Bank statements also show expenses that may not have been included in financial statements, such as bank fees for account services.

How To Do a Bank Reconciliation

Bank reconciliation statements safeguard against fraud in recording banking transactions. Discrepancies in bank reconciliations can arise from data processing errors or delays and unclear fees at the bank. Unpredictable interest income may also be a challenge when calculating financial statements, which can lead to challenges during a bank reconciliation. Bank reconciliation isn’t just important for maintaining accurate business finances—it also ensures your customer and business relationships remain strong. Regular bank reconciliation double-checks that all payments have been accurately processed. This includes payments by customers to your company and payments from your company to employees, contractors, and other goods and services providers.

Adjusting the General Ledger Balance

It is important to note that it takes a few days for the bank to clear the checks. This is especially common in cases where the check is deposited at a different bank branch than the one at which your account is maintained, which can lead to the difference between the balances. Bank reconciliation helps to identify errors that can affect estimated tax payments and financial reporting. Checks which have been written, but have not yet cleared the bank on which they were drawn. In the bank reconciliation, outstanding checks are deducted from the balance per bank. Hence, at the end of each month, the first thing to do is to consult the bank reconciliation statement prepared at the end of the previous month.

Performing regular bank reconciliations helps you stay on top of cash flow, keep organized records for tax season, and minimize the risk of fraud and theft. We’ll explore the definition of bank reconciliation, why it’s important, and a step-by-step process for performing bank reconciliations. We’ll also look at common sources of discrepancies between financial statements and bank statements to help you identify fraud risks and errors. Performing regular bank reconciliations is key to keeping on top of your company’s financial health and paving the way for sustainable business growth. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement.

Bank Reconciliation Statement FAQs

You can also opt to use a simple notebook or spreadsheet for recording your transactions. Reconciling your bank statement used to involve using a checkbook ledger or a pen and paper, but modern technology—apps and accounting software—has provided easier and faster ways to get the job done. Regardless of how you do it, reconciling your bank account can be a priceless tool in your personal finance arsenal. The purpose of reconciling bank statements with your business’ cash book is to ensure that the balance as per the passbook matches the balance as per the cash book.

Greg’s January financial statement for the company shows $100,000 in cash, but the bank statement shows only $88,000. Let’s take a look at a hypothetical company’s bank and financial statements to see how to conduct a bank reconciliation. It’s recommended for a company to perform a bank reconciliation at least once a month.

- At times, you might give standing instructions to your bank to make payments regularly on specific days to third parties, such as insurance premiums, telephone bills, rent, sales taxes, etc.

- To create a bank reconciliation, you will need to gather your bank statements and reconcile them with your accounting records (ledger).

- They also can be done as frequently as statements are generated, such as daily or weekly.

- Performing regular bank reconciliations is key to keeping on top of your company’s financial health and paving the way for sustainable business growth.

- All of our content is based on objective analysis, and the opinions are our own.

If you do your bookkeeping yourself, you should be prepared to reconcile your bank statements at regular intervals (more on that below). If you work with a bookkeeper or online bookkeeping service, they’ll handle it for you. Once you determine the differences between the balance as per the cash book and the balance as per the passbook, you’ll need work out the balance as per the bank portion public accounting ms of the bank reconciliation statement. As a result, you’ll need to deduct the amount of these checks from the balance. Make sure that you’ve also taken into account all deposits and withdrawals to an account when preparing the bank reconciliation statement. When you compare the balance of your cash book with the balance showcased by your bank passbook, there is often a difference.

While this will cause a discrepancy in balances at the end of the month, the difference will automatically correct itself once the bank collects the checks. One of the procedures for establishing the correct cash balance (and for controlling cash) is the reconciliation of the bank and book cash balances. After including all the amounts identified in Step 3, your statements should display the same final balance.

(a) Deposits made by Sara Loren on 30 May, $1,810, and on 31 May, $2,220, have not been credited to the bank statement. More specifically, you’re looking to see if the “ending balance” of these two accounts are the same over a particular period (say, for the month of February). Bank reconciliations are like a fail-safe for making sure your accounts receivable never get out of control. And if you’re consistently seeing a discrepancy in accounts receivable between your balance sheet and your bank, you know you have a deeper issue to fix. Once you’ve completed the balance as per the bank, you’ll then need to work out the balance as per the cash book. At times, you might give standing instructions to your bank to make payments regularly on specific days to third parties, such as insurance premiums, telephone bills, rent, sales taxes, etc.